Case (![[personal profile]](https://www.dreamwidth.org/img/silk/identity/user.png) case) wrote in

case) wrote in ![[community profile]](https://www.dreamwidth.org/img/silk/identity/community.png) fandomsecrets2020-02-19 05:38 pm

fandomsecrets2020-02-19 05:38 pm

[ SECRET POST #4793 ]

⌈ Secret Post #4793⌋

Warning: Some secrets are NOT worksafe and may contain SPOILERS.

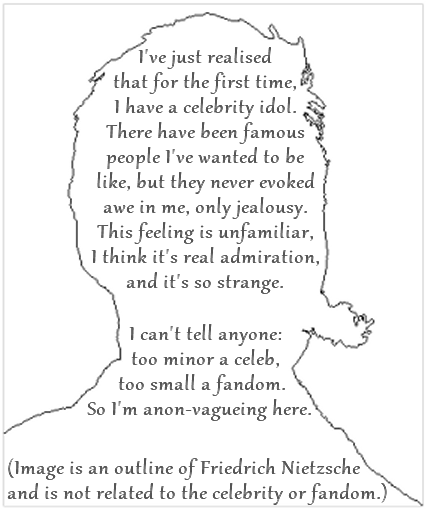

01.

__________________________________________________

02.

__________________________________________________

03.

__________________________________________________

04.

__________________________________________________

05.

__________________________________________________

06.

__________________________________________________

07.

__________________________________________________

08.

__________________________________________________

09.

Notes:

Secrets Left to Post: 01 pages, 18 secrets from Secret Submission Post #686.

Secrets Not Posted: [ 0 - broken links ], [ 0 - not!secrets ], [ 0 - not!fandom ], [ 0 - too big ], [ 0 - repeat ].

Current Secret Submissions Post: here.

Suggestions, comments, and concerns should go here.

Re: Homeownership

(Anonymous) 2020-02-20 04:58 am (UTC)(link)The process turned out to be easier than I expected and yet still rather opaque because every explanation I found seemed way overly simplistic for such a huge purchase. I tried taking a community ed class on home buying and it was a confusing mess because the person teaching it was one of those people who clearly knows their stuff but has no idea how to teach it (doesn't know how to begin at the beginning/with a common frame of reference, doesn't define their terms, etc.) The best thing I did was get a buyer's agent to guide me through the home shopping process and send me possible houses to look at. Before that step, you need to get the financial stuff in order.

REALLY IMPORTANT: find out what the property taxes are in your area (or what they have been recenyly on the properties you are looking at - I think Zillow gives you that info) so you are calculating your expected monthly payment most accurately. Don't just use an online mortgage calculator with a tax rate left to default (which might be the national average or something) because if the tax rate is relatively high in your area, you could be grossly overestimating how much house you can afford if you don't account for the correct tax rate.

I would say research those programs that let you have a low down payment to see how you could get in on that, and be aware that if you put down less than 20% you have to pay for something called mortgage insurance (note: when you have paid off enough of the mortgage [20%?] you can cancel the mortgage insurance, but they probably won't stop charging you automatically so you have to pay attention).

You want to get pre-approved for a mortgage so you aren't rushing to do that after you find a condo to buy (it might get nabbed by someone else who was already ready to put in an offer - the house I bought was barely on the market for a couple of days before my offer was accepted). You get approved for a certain maximum amount. Your credit score matters a lot.

Remember that closing costs are a thing, as is paying for a home inspector. That increases the amount of money you need to have on hand when you actually close on your house. Unless you have a pretty high monthly income and can replenish your savings quick, don't drain your savings account to buy a house or you will have nothing to pay for that furnace repair 3 months in.

Honestly, for me buying a house felt like a totally lateral move. It's the same size as my old apartment (although I get a larger garage and don't halve to share the basement), is in the same neighborhood, costs about the same to heat, and was even built around the same time. Everyone kept acting like I must save so much more space and everything must be so amazing and I was like "Guys, it's really just the same." Yes, I have to be prepared to spend money on maintenance but I don't have to worry about my rent going up.

That was really rambling, sorry!

Re: Homeownership

(Anonymous) 2020-02-20 01:24 pm (UTC)(link)